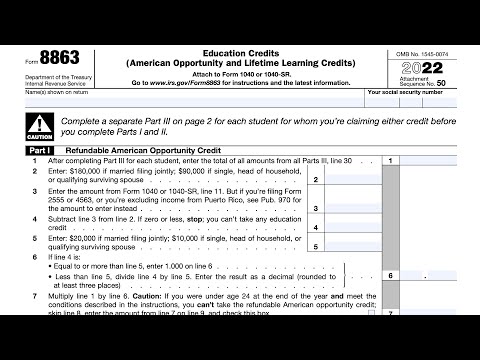

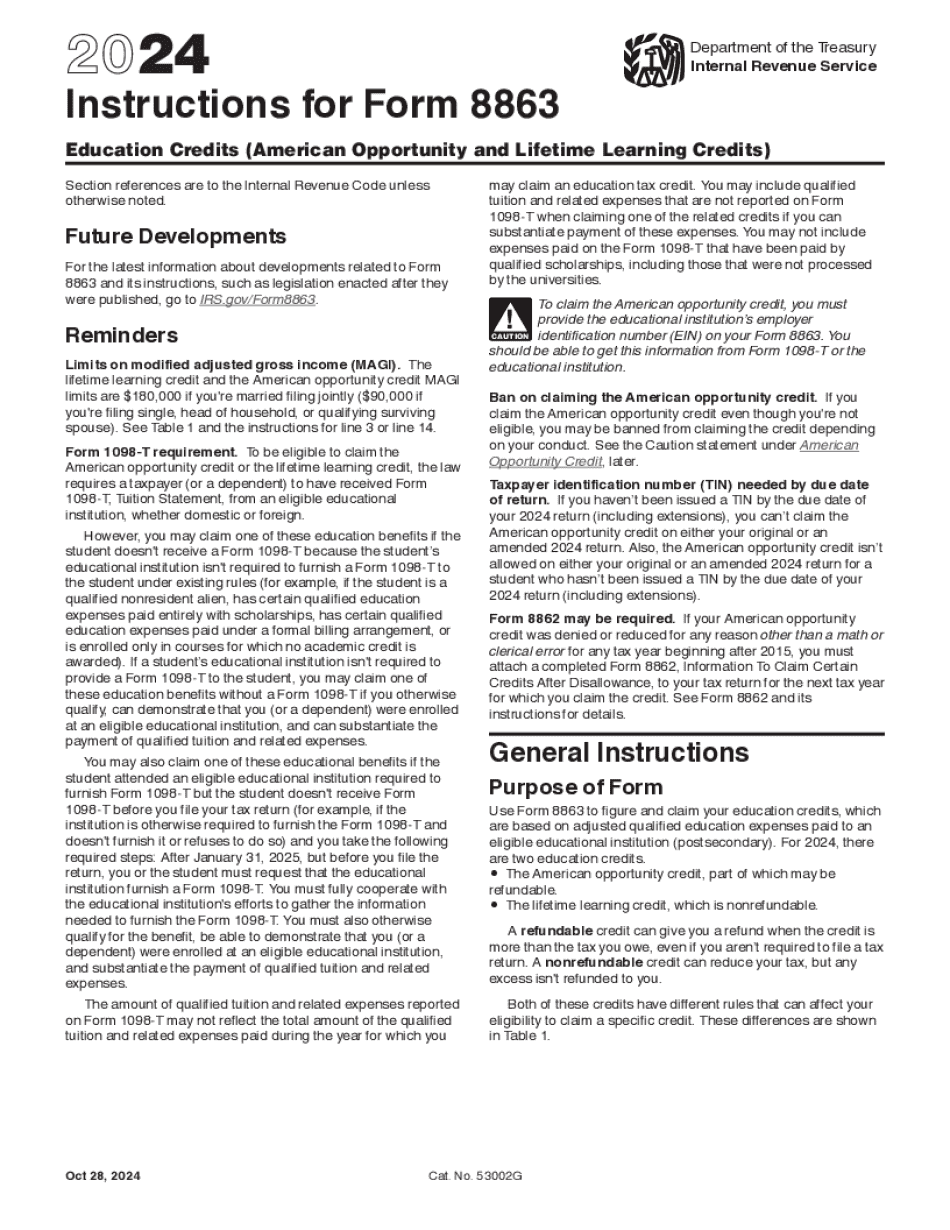

Going over IRS form 8863 education credits so this is the tax form that a lot of taxpay payers will be using to claim an education credit for either the American Opportunity tax credit or the lifetime learning credit before we get into the form itself we're going to take a few moments to go into a little bit more depth about each tax tax credit so the American Opportunity tax credit is probably the one that most taxpayers with younger children that are going off to college young adults first four years they're probably more familiar with the American Opportunity tax credit because a it's a larger tax credit and it is only available for the first four years of a post-secondary education after that first four years the assumption is that you can continue to take tax credits over the course of your life for different educational opportunities that you take advantage of and that would be under the lifetime learning credits so a couple of things about the American Opportunity tax credit uh as you as you will see when we go through this tax form kind of breaks down a couple of uh criteria so first four years uh part of it is refundable tax credit which means the refundable part of the tax credit can actually reduce your tax liability below zero so in other words normally if you have a two thousand dollar tax credit and your tax liability is only a thousand dollars then a non-refundable tax credit like most are would reduce your tax bill to zero and then you would have a credit that's disallowed in that it can't reduce your tax liability below zero uh depending on the type of credit you may be able to carry it forward or...

Award-winning PDF software

How to prepare Form Instructions 8863

About Form Instructions 8863

Form Instructions 8863 is the set of guidelines and explanations provided by the Internal Revenue Service (IRS) for completing Form 8863, which is also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form. This form is used by taxpayers to claim educational tax credits for qualified education expenses paid for themselves, their spouse, or their dependents. Individuals who have incurred eligible education expenses, such as tuition and certain related expenses, at an accredited institution of higher education may need to complete Form 8863. This form enables taxpayers to claim either the American Opportunity Credit or Lifetime Learning Credit, depending on their eligibility and the expenses they have incurred. Students or their parents/guardians who qualify and wish to reduce their tax liability by claiming educational credits may need to follow the instructions outlined in Form Instructions 8863.

What Is Instruction 8863?

Online technologies help you to organize your file administration and boost the productiveness of the workflow. Observe the brief tutorial in an effort to fill out Form Instruction 8863?, stay clear of mistakes and furnish it in a timely way:

How to fill out a fill out form 8863?

-

On the website with the form, click on Start Now and move to the editor.

-

Use the clues to complete the pertinent fields.

-

Include your personal details and contact details.

-

Make absolutely sure that you choose to enter correct information and numbers in suitable fields.

-

Carefully check out the written content of the blank as well as grammar and spelling.

-

Refer to Help section when you have any concerns or address our Support team.

-

Put an electronic signature on the Form Instruction 8863? Printable while using the help of Sign Tool.

-

Once document is completed, click Done.

-

Distribute the prepared via electronic mail or fax, print it out or save on your device.

PDF editor lets you to make improvements on your Form Instruction 8863? Fill Online from any internet linked gadget, customize it in accordance with your requirements, sign it electronically and distribute in several means.

What people say about us

How you can complete templates without having mistakes

Video instructions and help with filling out and completing Form Instructions 8863