In this episode of cocktail tacs, I'll be explaining how you can save up to $2,000 on your tax return using the Lifetime Learning credit. So stay tuned! Hello, my friends and subscribers at the MK Chip community, I'm MK the CPA, and along with my sidekick Chipper, we teach people information that matters so you can live your life on cage. Today, I will be showing charts and slides throughout this video. If at any time you feel I'm going too fast, feel free to pause the video at any point and we can resume from there. Now let's dive right into it. Okay, so how much is the Lifetime Learning credit worth? The answer is up to $2,000 per return. Now notice, I did not say per student like I did in the American Opportunity Credit video. So it's up to $2,000 per tax return. So what this means is, even if you have multiple kids or students in college at the same time, the maximum amount of this credit you can take on your tax return is limited to $2,000. And the way that's calculated is, it's the credit is 20% of the first eligible $10,000 in qualified education expenses. So up to $2,000 per return. Now you may be asking, who can claim the credit? The rules for the Lifetime Learning credit, in terms of who can claim the credit, mirror that of the American Opportunity Credit. So the only person who can claim the credit is a person who can claim themselves on their tax return. Many people asked if they can claim more than one education credit. The answer is yes, but do understand you can only claim one education credit per student per tax year. So you might be able to claim, if...

Award-winning PDF software

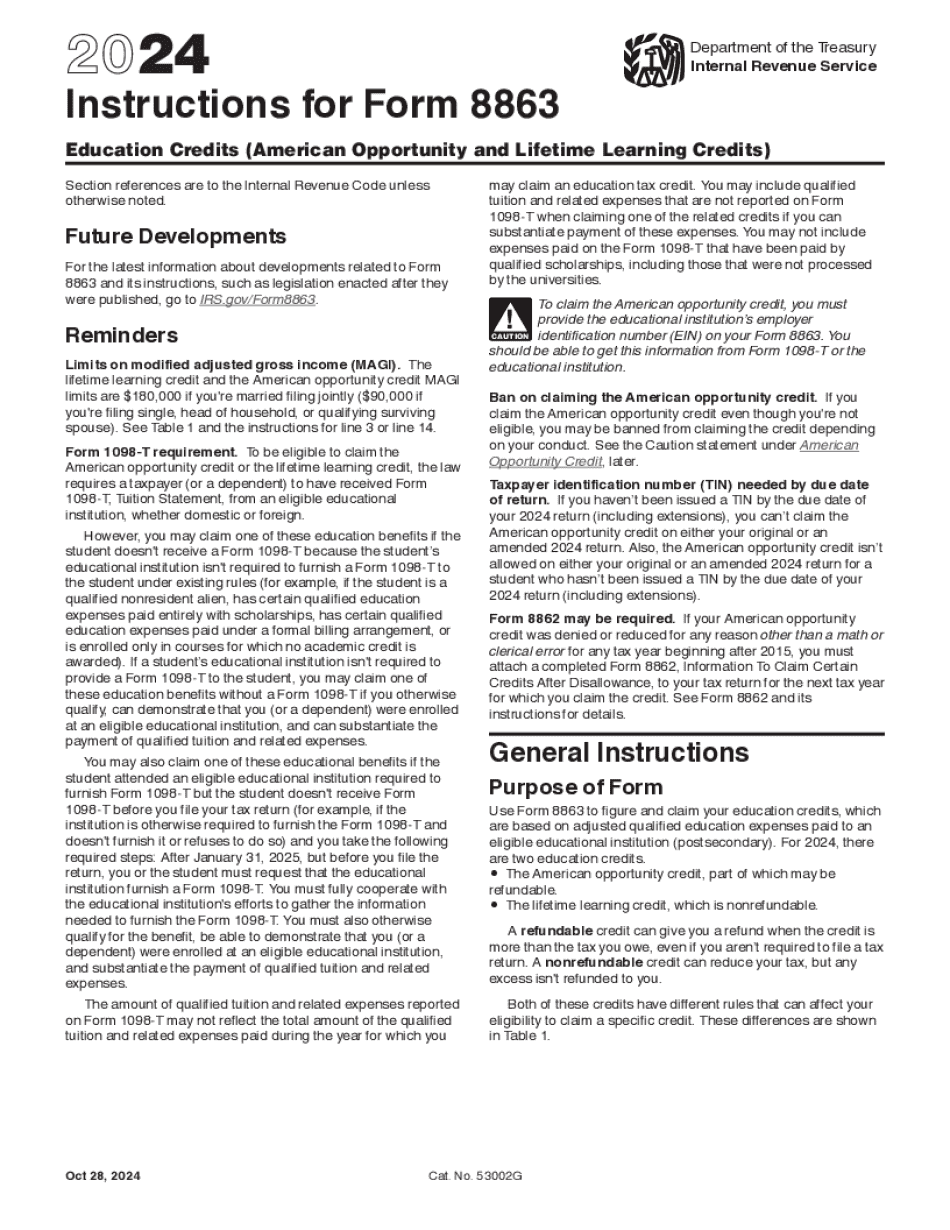

8863 Instructions 2025 Form: What You Should Know

The credit is figured based on the number of school credits you claim. In addition, the credit is limited to two per year. The IRS currently accepts three types of form(s): Form 1040EZ Form 1040NR Form 1040A Form 8863 can be applied to a student who attended an eligible postsecondary institution that granted a certificate or degree that meets these requirements. The certificate or degree must satisfy both the minimum requirements for the program that it's equivalent to — in this case, it must be a certificate or degree in a field listed on Form 1040-NR.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 8863, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 8863 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 8863 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 8863 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8863 Instructions 2025