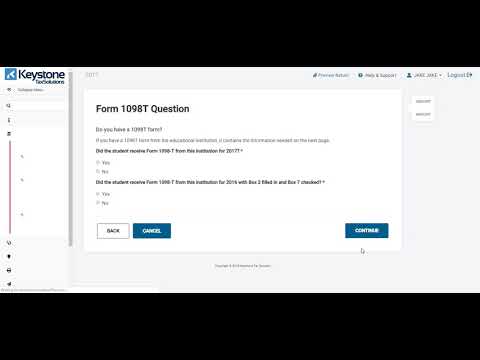

Hello guys, today I'll be showing you how to add the 8863 form to your client's tax return. This form is for anyone who has claimed an education credit. To find the form, you can either use the search bar on the left and type in "8863" or go to the deduction section and click on "credits." Next, select the education credits form 1098-T. If your client needs this form to claim the credit, click "yes." Choose the person for whom the form is intended and click "continue." Answer the following questions: 1. Has the client used this credit within the past four years? - Click "no." 2. If the student enrolled at least half-time, did they complete four years of post-secondary education? - Click "yes" for half-time enrollment and "no" for completing four years. 3. Was the student convicted of any felony before the end of the tax year? - Click "no." Next, indicate if the student received the 1098-T form from the institution. If yes, check the . Enter the institution's name, address, and EIN (employer identification number) and click "continue." Now, you'll be asked to input the amount from the 1098-T form. Put the exact amount or an estimated figure in the provided field and click "continue." The system will calculate the return and determine if the client qualifies for the credit. Once the calculation is complete, you can see any adjustments made to the refund on the right-hand side. That's it! You've successfully completed the process.

Award-winning PDF software

8863 2025 Form: What You Should Know

The form should be filed if the taxpayers, their spouse or dependent (indicated on the tax return) (filed as qualifying students under the tax law or as dependent students eligible for the Education Credits provision). The education credits are designed to offset updated for current information. Tax return What if the taxpayers, with or without their dependent children, were both enrolled in the same qualified higher education program during the tax year? The return is filed for that taxpayer. The student is eligible for the education credits and should be listed on the tax return as a qualifying student. For more info, see Education Credits (Other), earlier. Fill Online, Printable, Fillable, Blank What is the Education Credits Form 8863 for? The form should be filed if the taxpayers, their spouse or dependent (indicated on the tax return) received qualified additional education expenses, not including qualified higher education expenses, for the first time during the year after filing the form. The education credits are designed to offset updated for current information. Tax return What if the taxpayers, with or without their dependent children, were both enrolled in the same qualified higher education program during the tax year? The return is filed for that taxpayer. The student is eligible for the education credits and should be listed on the tax return as a qualifying student. For more info, see Education Credits (Other), earlier. Fill Online, Printable, Fillable, Blank What if the taxpayers, with or without their dependent children, were both enrolled in the same qualified higher education program during the tax year? The return is filed for that taxpayer. The student is eligible for the education credits and should be listed on the tax return as a qualifying student. For more info, see Education Credits (Other), earlier. Fill Online, Printable, Fillable, Blank What is the Education Credits Form 8863 for? The form should be filed if the taxpayers, their spouse or dependent (indicated on the tax return) received qualified educational, living condition, or training benefits during the year after filing the form. The education credits are designed to offset updated for current information.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instructions 8863, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instructions 8863 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instructions 8863 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instructions 8863 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8863 2025